when will i get my mn unemployment tax refund

You cannot withhold UI tax from the wages you pay to employees. If a credit cannot be used a refund will be paid.

MN Department Of Revenue Will Begin Sending Tax Refunds For PPP Loans And Extra Jobless Aid In Next Few Weeks July 1.

. Employers that overpay their unemployment insurance tax amount due for a quarter can request a credit adjustment within four years from the date the tax payment was originally due. These tax law changes were enacted July 1 2021 along with other retroactive provisions affecting tax years 2017 to 2020. View step-by-step instructions for accessing your.

We know these refunds are important to those taxpayers who have experienced hardships over the last year and a half. Tax season started Jan. Caroline Cummings Melissa.

When will I get my unemployment tax refund. So far the refunds have averaged more than 1600. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020 You do not need to take any action if you file for unemployment and qualify for the adjustmentIf the IRS has your banking information on file youll receive.

The IRS anticipates most taxpayers will receive refunds as in past years. However not everyone will receive a refund. MN Department Of Revenue Will Begin Sending Tax Refunds For PPP Loans And Extra Jobless Aid In Next Few Weeks.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Sadly you cant track the cash in the way you can track other tax refunds. Federal and MN State unemployment tax refund.

The Taxable wage base for 2022 is 38000. The jobless tax refund average is 1686 according to the IRS. 335 on up to 40950 of taxable income for singles and up to 68400 for joint.

If you dont the IRS will mail your return as a physical check to the address on file. By Caroline Cummings July 1 2021 at 517 pm. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

Minnesota Law 268057 Subd7. The unemployment exemption is being implemented in certain states but not all for. Tax rate factors for 2022.

For step-by-step instruction to request a credit adjustment and. They have about. Hello Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point.

State Taxes on Unemployment Benefits. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. About 500000 Minnesotans are in line to get money back from the tax break on the first 10200 of 2020 unemployment benefits.

As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. Within 30 days of correcting the IRS will send you a notification detailing the changes. Another way is to check your tax transcript if you have an online account with the IRS.

Sadly you cant track the cash in the way you can track other tax refunds. When Should I Expect My Tax Refund In 2022. More than 100000 Minnesota businesses received Paycheck Protection.

Mail to Minnesota employers on or before December 15 2021. Weve finished adjusting and issuing refunds for all 2200 entity-level corporate returns affected by the PPP changes. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments issued during the pandemic likely wont go out until September a Department. If you received unemployment in 2020 youll likely get money back from the Minnesota Department of Revenue. In addition to the refund on unemployment benefits people are waiting for their regular IRS tax refunds.

All 2022 Unemployment Insurance Tax Rate Determinations were sent out by US. Your UI tax rate is applied to the taxable wages you pay to your employees. The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness.

Credit adjustments refunds. Most should receive them within 21 days of when they file electronically if they choose direct deposit. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. Unemployment compensation is taxed in Vermont. It is too late to change your address for the 1099-G mailing but you can access your 1099-G online.

We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31 2022. Meanwhile the manual processing which involves returns with more complicated tax circumstances began the week of September 13. The department expects these returns and refunds to be completed by the end of the year in time for New Years Eve.

Your refund will most likely display as IRS TREAS 310 TAX REF if you have a direct deposit account. We expect to adjust and issue refunds for the remaining 10000 affected returns early in 2022. 24 and runs through April 18.

State Income Tax Range. Another way is to check your tax transcript if you have an online account with the IRS.

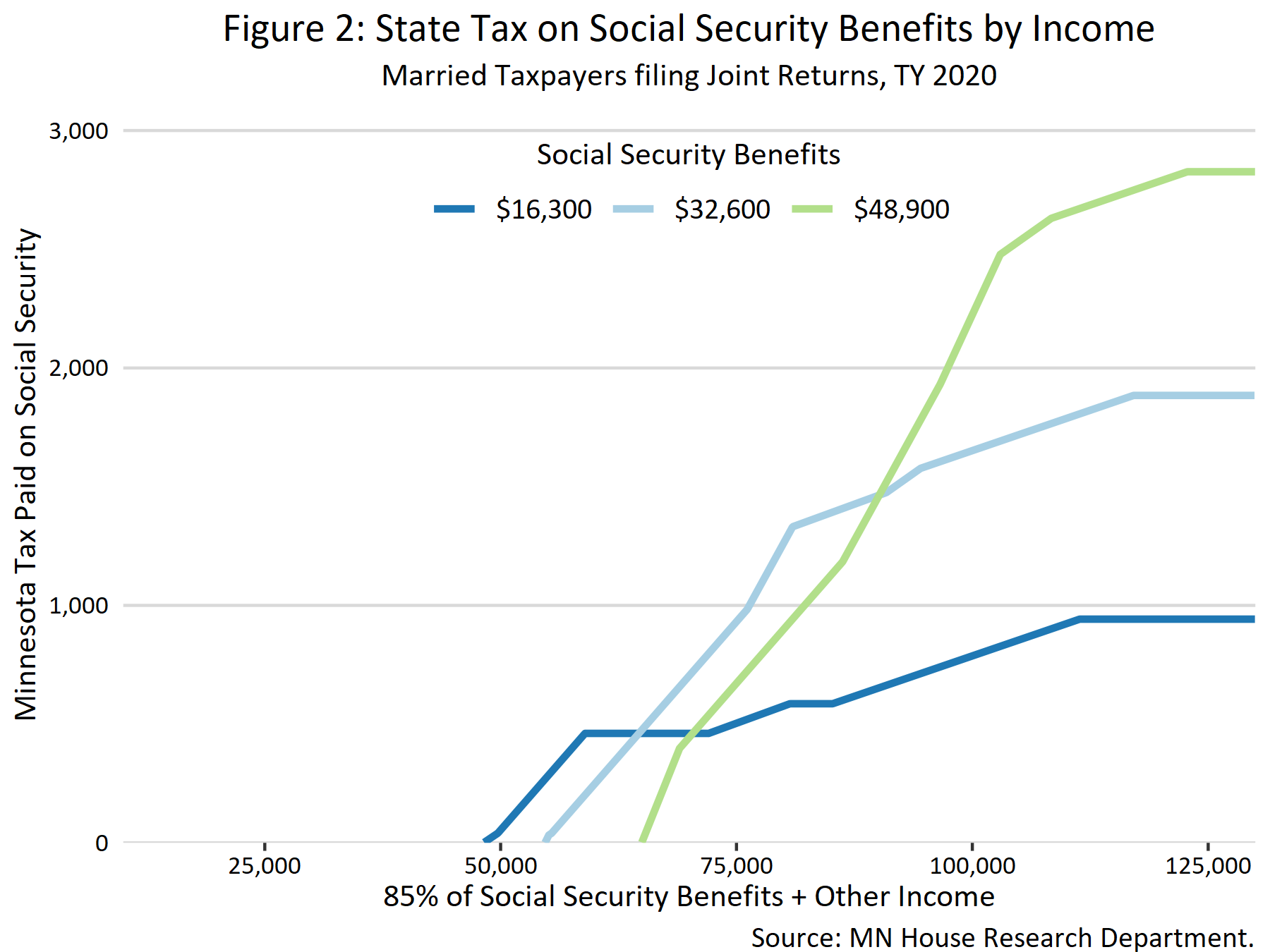

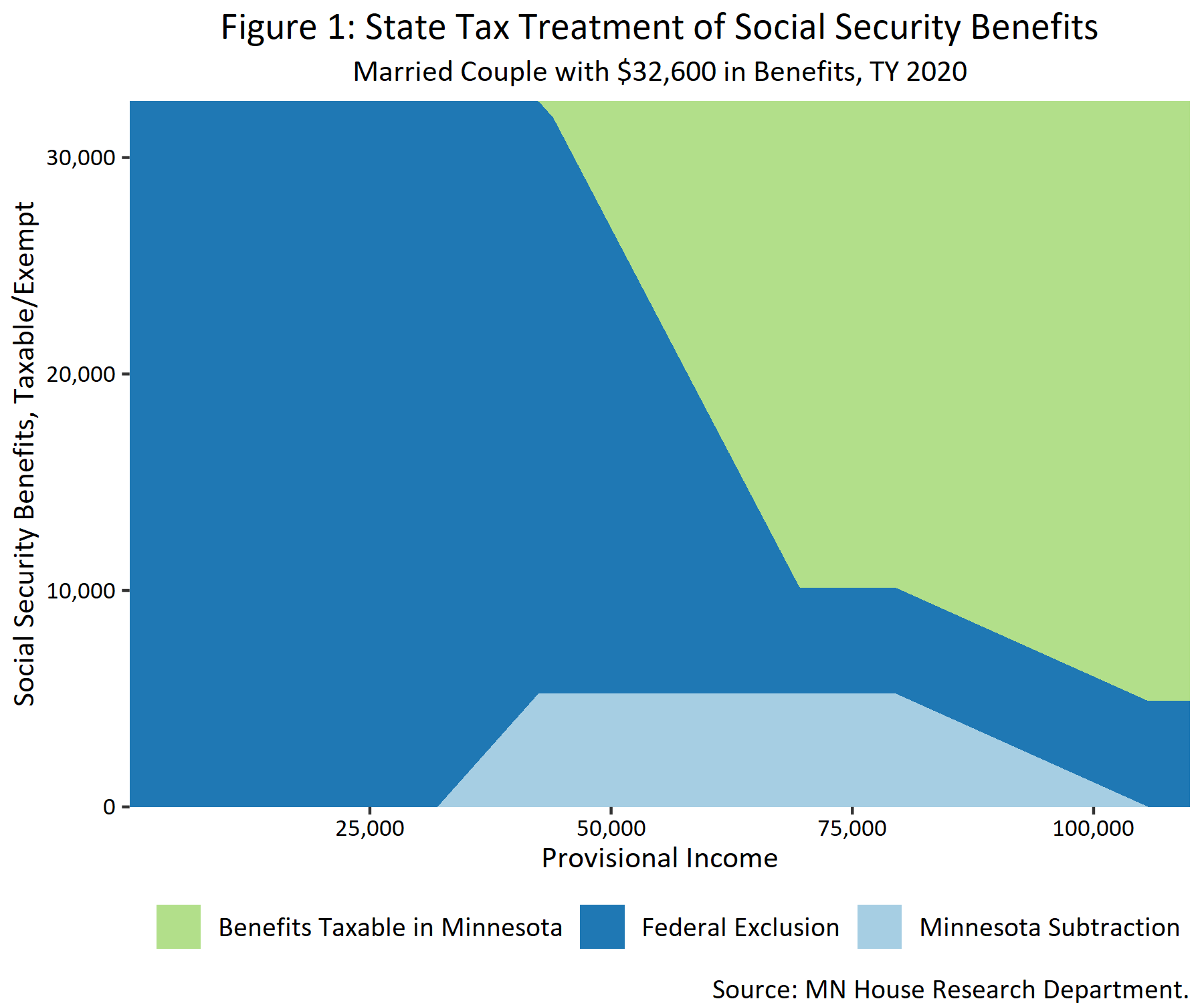

Taxation Of Social Security Benefits Mn House Research

Minnesota State Tax Refund Mn State Tax Brackets Taxact Blog

File 2021 Minnesota State Taxes Together With Your Irs Return

Minnesota Salt Cap Workaround Salt Deduction Repeal

Where S My Refund Minnesota H R Block

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

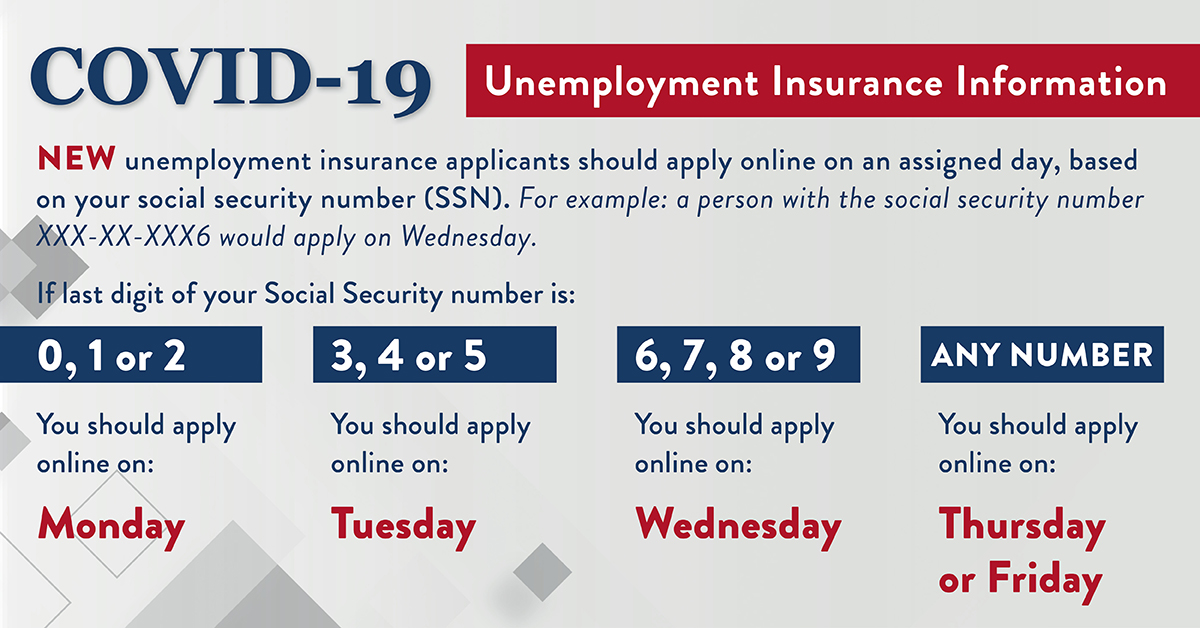

Covid 19 Policy Updates Minnesota Chamber Of Commerce

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Taxtime Income Tax Starting A Daycare Daycare Business Plan Daycare Forms

House Dfl Proposes Fifth Tier Income Tax For High Earners Some Relief For Ppp Loans And Jobless Benefits Wcco Cbs Minnesota

Taxation Of Social Security Benefits Mn House Research

It Turns Out Minnesota Didn T Actually Lose Any Tax Money During The Covid Recession Minnpost

Still Rolling In It Latest Report Show Minnesota Tax Revenues Continuing To Surpass Projections Minnpost

State Of Minnesota Passes 2021 Tax Bill Bgm Cpas

Still Rolling In It Latest Report Show Minnesota Tax Revenues Continuing To Surpass Projections Minnpost

When Will Irs Send Unemployment Tax Refunds Kare11 Com

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Minnesota Finally Conforms To Several Federal Tax Law Changes Boulay Group

Minnesota Tax Collections Continue To Outpace Projections Even As First Signs Of Delta Variant S Effect Emerge Minnpost

Minnesota Tax Collections Continue To Outpace Forecast Minnpost